The SaaS Trends Report

Introduction

Software spend continues to be scrutinized at record highs, but informed buyers know you can gain an advantage in purchasing decisions one way: data.

More than ever, buyers need to understand fair pricing, purchasing terms, and negotiation strategies. So, in our Q3 SaaS Trends Report, we’re amping the data up a level.

Vendr is one of the world’s largest software buyers. Processing more than $3B of software spend has given us a unique vantage point on SaaS trends. In this report, we examine price hikes, tech stack consolidation, and the companies and categories that are winning big in SaaS right now.

But at the end of the day, it’s never been about us. Vendr’s power is within our community, which is why the coming pages are also jam-packed with insights from our customers and team of SaaS experts.

As our thank you, we’re giving every reader access to one free Buyer Guide. Buyer Guides are software purchasing playbooks packed with precise, actionable insights to help you understand what a fair price is, negotiate smarter, and learn from our community of SaaS buyers. Read on for your access, everything you need to know about SaaS buying in Q3, and predictions for what’s ahead as we close out the year.

Year of the Price Hike?

Average Annualized Contract Value (ACV) rebounds, climbing 43% QoQ, but remains lower than three-year average.

Why this matters

Tracking ACV helps us identify shifts in pricing strategies from suppliers and purchasing strategies from buyers.

Key insights

- Last quarter, ACV hit a three-year low at $62k. This quarter, ACV rose 43% to $89k. While this was a stark increase, it’s still on the low end of what we’ve seen historically.

- ACV is down 17% YoY, compared to Q3 2022.

- Salesforce, Microsoft, and many other major suppliers have made headlines for price hikes of up to 25% this year.

- As buyers look to reduce costs, they’re scrutinizing line items and cutting seats. Sellers know that buyers are prioritizing efficiency, which is why many are raising their prices in attempts to maintain ACV levels.

- ACV was highest in Security and Compliance, IT Infrastructure, Collaboration and Communication, and Marketing and Advertising categories — each of which landed above $100k on average.

In February of this year, Vendr predicted 2023 to be the year of the price hike. Our reasoning? In software, a few large companies always eat first (think AWS, Google, etc.). These providers know that even if they raise their prices, it’s hard for users to churn. Throughout this year, Microsoft, Salesforce, ServiceNow, and more have made headlines announcing price hikes up to 25%.

This quarter, our data also reflected the price hikes.

The above chart shows all contract renewals, separated by whether the price increased or decreased. For four quarters, the number of contracts with price increases was dropping, while the number of contracts with price decreases was climbing. That changed in Q3 2023, when there were more contracts with price increases than decreases.

Key insights

- It’s not just prices going up. Customer Acquisition Cost (CAC) is at a three-year high and has more than doubled since 2020, according to Clouded Judgement. This means it’s taking companies 48 months to pay back their costs from acquiring a customer.

- Many suppliers are also changing terms, which buyers should study closely upon renewal.

- As evidenced by data in the next section, many companies are limiting or even freezing net-new purchases. This means many buyers are incentivized to renew existing contracts. Suppliers are capitalizing on this by negotiating renewals aggressively.

We’ve seen suppliers using short renewal windows and an emphasis on their R&D investments to raise prices at renewal. In the current environment, it's important to start renewal conversations early (90 days) and not be afraid to leverage competition. The expectation should be for suppliers to invest in their products to stay competitive and maintain your business.

– Shannon Gardner, Senior SaaS Consultant

Many suppliers are changing contract terms. We’ve noticed an uptick in suppliers deviating from standard net-30 terms and opting for net-15 by default. When it comes time to renew, check if these terms have changed. More suppliers are also including standard uplifts in contracts, which are typically negotiable. We always recommend making sure your uplift falls within the 3-5% range, if not lower.

– Michael Singer, Principal SaaS Consultant

Top Community Insights on price hikes:

Notion

"Notion is increasing their prices. For the same number of users, we paid $15/mo last year. The renewal initially was for $19.56/user/mo, but with enforcing our long term partnership and budget constraints, we were able to get it down to $18/user/mo for Enterprise."

Zendesk

"Zendesk had a price increase on July 2023, which raised our per-user cost by 13%. We pushed back on budget and concerns about increasing seat count during the term. We were able to get a flat renewal at our previous per-user cost."

Carta

"Carta indicated in October 2023 that they are going through a price increase/"correction" for legacy pricing. Standard terms are a 30 day notice of price increases >7%. Be wary."

LinkedIn

"LinkedIn raised pricing on the Career Pages - SMB Basic package from $10K to $20K. However, we said this change was not budgeted for and were able to maintain the previous pricing."

Suppliers with the badge are a part of the invite-only Vendr Verified program. Vendr Verified sellers have our stamp of approval, and have agreed to a transparent best price and satisfaction guarantee for those buying through Vendr.

Tech Stack Consolidation

Net new purchases down 37% YoY

Why this matters

One of the most common themes we’ve heard this year is that SaaS buyers are less focused on buying new software, and more focused on making sure they have the best deal possible for all renewals.

In 2022, 30% of all purchases were net-new, and 70% were renewals. So far this year, that number is down 37%, with just 19% of purchases being net new.

In Q3, net new purchases made up just 17% of transactions on Vendr’s platform.

Many buyers have implemented more stringent processes for approving net new purchases, so I’m seeing more renewals come across my desk than ever before. Sellers are responding to this by negotiating and dangling upsells on renewals more aggressively.

– Tommy Ranucci, Principal SaaS Consultant

Buying cycles have increased 37% for net new purchases

Why this matters

Buying cycles increase when buyers are negotiating more aggressively and proceeding into deals with caution. Tracking how long it takes to buy SaaS helps us understand the mentality of buyers and sellers.

Key insights

- In the last three years, buying cycles increased 37% for net new purchases and 8% for renewals. The impact? Companies are forced to invest more in sales and marketing to get every deal across the finish line, creating a significant impact on CAC and company revenue.

- As companies scrutinize spend, more people get involved in purchases, and buying cycles take longer. In many cases, the CFO is the decision maker on every deal.

- Renewals, on average, take 15% longer than net new purchases, clocking in at 51 days this quarter. Why? Companies are treating renewals as if they’re new purchases. This means they’re beginning the renewal process earlier to look at competitive alternatives and determine where they can downsize or make adjustments.

Negotiations make up 54% of the buying cycle

Why this matters

Both buyers and sellers of software should aim to shorten buying cycles to increase efficiency. Negotiation often represents the longest phase of the buying cycle.

In recent years, an increased number of SaaS companies have gotten bold and cut out negotiation altogether. In other words, they’ve put a death to their own discount. The sticker price is the sticker price; no one gets a special deal.

The impact of this is massive. For example, Figma doesn’t negotiate. Their average buying cycle on Vendr’s platform? Eleven days, or 75% less than the average net new purchase on Vendr’s platform, creating a much more efficient buying cycle.

Negotiations take longer as deal size increases.

In general, the larger the contract, the longer the negotiation cycle. This means that as ACV rises, negotiation cycles take longer.

Vendr is known for negotiations, so some may wonder why we advocate for price standardization. It all comes down to efficiency. When buyers know they are getting a fair price, they buy faster – a major win for sellers. SaaS companies should transact more like selling a Tesla, not a used car.

– Ryan Neu, Co-Founder and CEO

Top Products

The top products purchased net new and renewed in Q3 2023

Why this matters

This chart shows which products software buyers purchased net new and renewed the most in Q3.

Key Insights

- Four of Q2’s top 10 net new purchases topped the charts again in Q3 including Linkedin, Gong , 6Sense, and NetSuite.

- Six products topped the renewal list back-to-back in quarters including Linkedin, Zoom, Salesforce, NetSuite, Docusign, and Slack.

Top-Purchased Categories

The top 25 categories purchased net new and renewed in Q3 2023, broken down by quantity of transactions per category

Why this matters

This chart shows which categories software buyers invested in most in Q3, helping CFOs and procurement teams gauge how the industry adjusts and expands tech stacks.

Key insights

- Within Data Analytics, the three subcategories with the fastest growth are Data Integration, Data Science and Analytics, and Business Intelligence. For each of these, average ACV and savings went down, while buying cycles extended QoQ. This means we’re seeing smaller deals with smaller savings, and transactions are taking longer.

- One subcategory to watch is Machine Learning and Artificial Intelligence, which experienced 85% growth QoQ, possibly pointing to companies building a strong foundation for a major onset of AI. While the category didn't crack our top 25 this quarter, we expect it to land in the top 25 soon if similar growth rates continue.

The SaaS Leaderboard: Q3 2023

The top-purchased products through Vendr in Q3 2023, organized by category.

The top three suppliers in Vendr’s top 25 categories by transaction volume in Q3 2023

Why this matters

Companies that can continue proving value during challenging quarters are most likely to have long-term success and stickiness. Here, the report highlights the top performers in the most popular categories who consistently bring value to customers, attract new ones, and increase industry market share.

Key insights

- For several quarters, companies have been laser-focused on mission critical software rather than the nice-to-haves. This quarter is no different with 8 of the top 25 categories falling within Security and Compliance or Data and Analytics

- Scroll down to see our category spotlight on Security and Compliance.

No one gets in trouble for investing too much in security. It’s a saying procurement leaders have heard for years, but perhaps has never been more true than now. As companies lean into mission critical software in 2023, Security & Compliance has proven to be resilient.

Why this matters

With rampant cyberattacks and companies managing more sensitive data than ever, ensuring security is increasingly important.

This category includes offerings like authentication tools, password managers, compliance monitoring, tools that monitor for cybersecurity threats, and more.

Key insights

- Security and Compliance purchases increased 25% QoQ from Q2 to Q3, and 27% YoY, compared to Q3 2022.

- ACV for the category also increased by 27% QoQ from Q2 to Q3.

As security concerns advance and become more targeted, we’re seeing customers requesting SOC2, Pen Test results, and security questionnaires for renewals and not just new purchases. The more up to date the protection, the faster security can approve.

– Logan Furbee, Senior SaaS Consultant

Top Suppliers by ACV

ACV and quantity of transactions for leading suppliers in Q3 2023

Why this matters

The average ACV in this chart tells us where the industry's pricing is moving. Buyers and sellers can assess the position of specific suppliers compared to competitors and alternatives. Additionally, this analysis reveals trends in the popularity of different products relative to ACV.

Key insights

- Most high-transaction suppliers fall within the $20k-$80k ACV range.

- Datadog Salesforce, and 6Sense have the highest ACVs, showing that mission-critical suppliers can charge more.

- Three of last quarter’s highest-transaction suppliers made a repeat appearance in the top five this quarter, including LinkedIn, Salesforce, and Docusign.

Vendr has the largest SaaS purchase dataset in the world. In Q3, we took our data and put it directly in the hands of our customers. SaaS Buyer Guides are software purchasing playbooks packed with precise, actionable insights to help you understand what a fair price is, negotiate smarter, and learn from our community of SaaS buyers.

Buyer Guides inform you where suppliers are willing to flex. For this report, we aggregated top commercial and discount levers from all our Buyer Guides to share the top levers working for all SaaS suppliers right now.

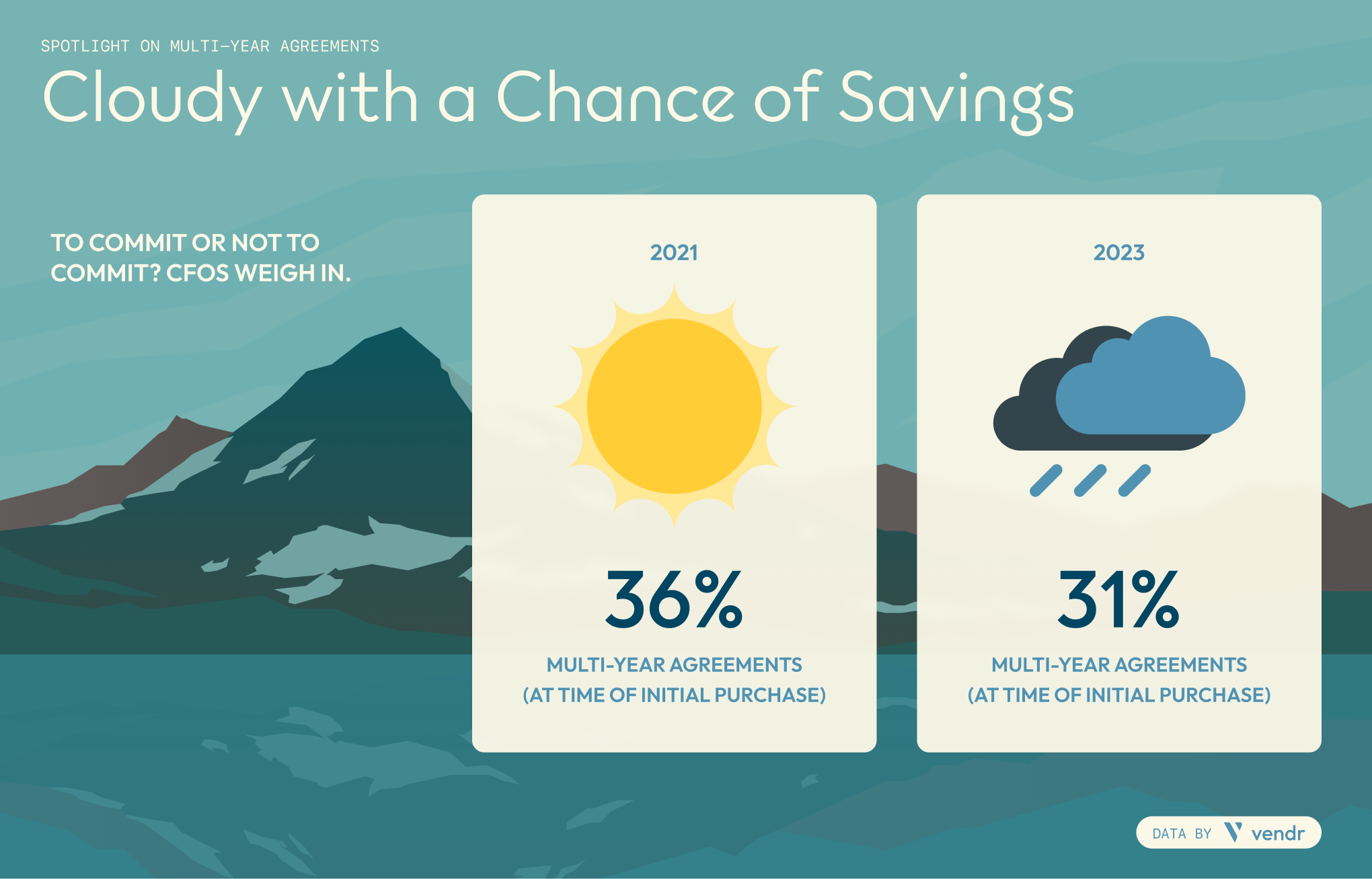

Multi-year agreements are down 14% for net new purchases and 28% for renewals, compared to 2021, as CFOs prioritize optionality

In the last two years, buyers on Vendr’s platform were 15% more likely to get a discount opting into a multi-year vs. a one-year agreement.

However, CFOs are opting for optionality and shifting buying behaviors back to 12-month agreements. Let’s take a look at Vendr’s data.

Every 12 months, you’re on the chopping block.

The growing trend toward 12-month agreements mandates that suppliers continuously win buyers’ trust each year. This pivot from longer-term agreements influences not just new purchases, but also renewals.

As of 2023, Vendr has seen a decline in multi-year agreements for new purchases, with multi-year agreements making up only 31%, a drop from 33% in 2022 and 36% in 2021.

When it comes to renewals, there's a more pronounced dip. Multi-year commitments have plummeted by 28% since 2021, with a mere 18% of renewal transactions favoring multi-year agreements this year.

Q4 Predictions

Q4 purchases to decline YoY.

Q4 is typically a high-purchase quarter, but with most companies having gone through re-forecasting this year, buyers will have less leftover budget to spend in Q4 than they have in the past. Next quarter, many decision makers will already be focused on 2024 spend.

Teams will face continued pressure to consolidate internally.

Throughout this process, finance teams will get closer to understanding how teams use tools and which tools are truly necessary.

The build vs. buy debate continues.

With many companies focused on cutting new spend, teams have been opting to build new tools vs. buy them. However, as finance teams get more involved, they may also begin encouraging buying new tools when it takes fewer resources than building.

Mission critical is the name of the game.

Sellers continue to have an increased understanding of how critical the products they sell are. Sellers who don’t sell mission-critical software will be more likely to negotiate on prices.

Ask and you (maybe) shall receive.

Buyers and sellers continue to find creative ways to make contracts work for both sides of the deal desk. Multi-year contracts, special language on uplifts, terms, and more will continue to be common. While some suppliers are holding firm on pricing, others are thrilled to get a deal. We always recommend letting the data guide your negotiation strategy.

Final Thought

Your key to simpler SaaS buying

Despite the economy, people are still buying and renewing SaaS, it’s just taking longer, costing more, and being done with more scrutiny. In other words, buying SaaS right now is difficult.

Vendr was founded on the belief that buying and selling SaaS should be easy, and we believe data is the key to making that happen.

That’s why we put out this report each quarter, and it’s also the why behind our brand-new offering, Vendr Intelligence Platform, aka VIP. VIP puts the data in your hands so you go into every purchase armed with fair pricing benchmarks, proven negotiation strategies, one click access to negotiation support. VIP is all about Your Voice + Our Data + Expertise.

Want to be one of the first to check it out? Email me ryan@vendr.com and we’ll hook you up with a sneak peak. Here’s to closing out 2023 strong, together.